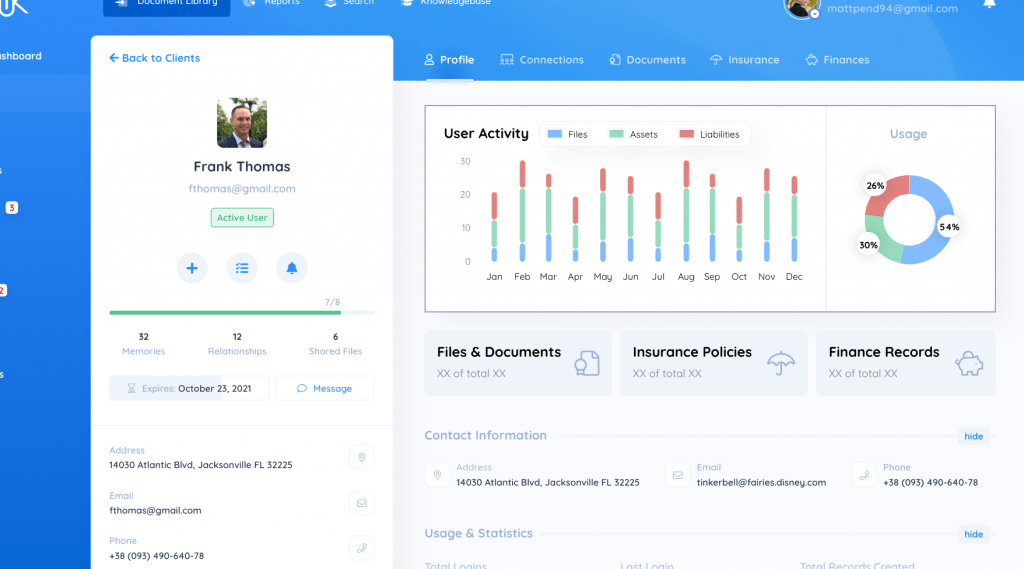

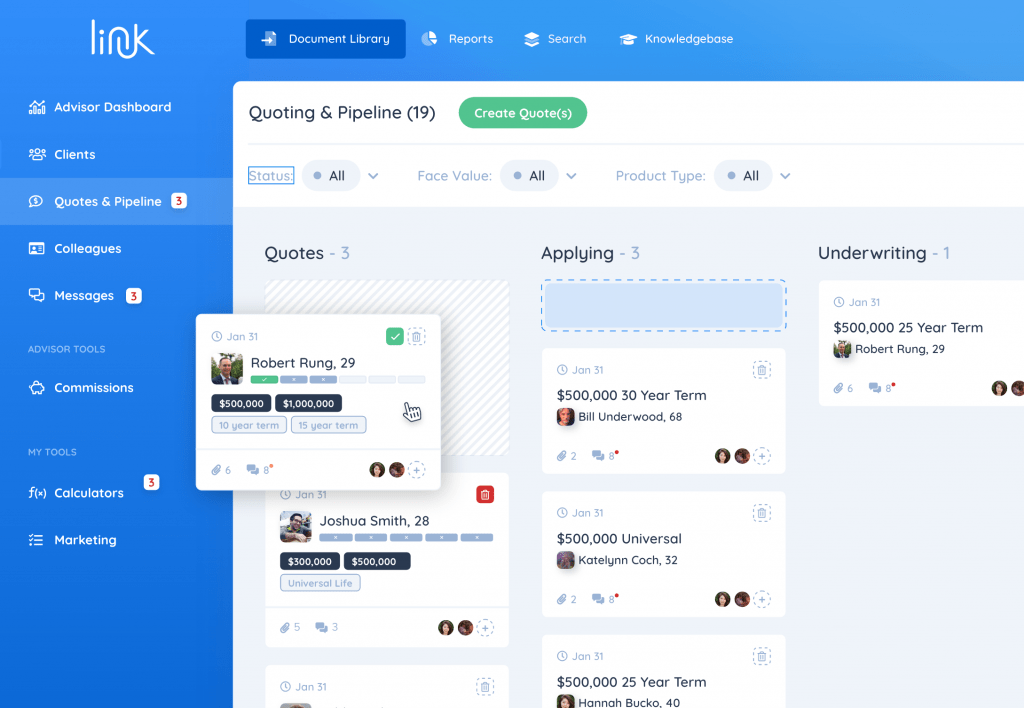

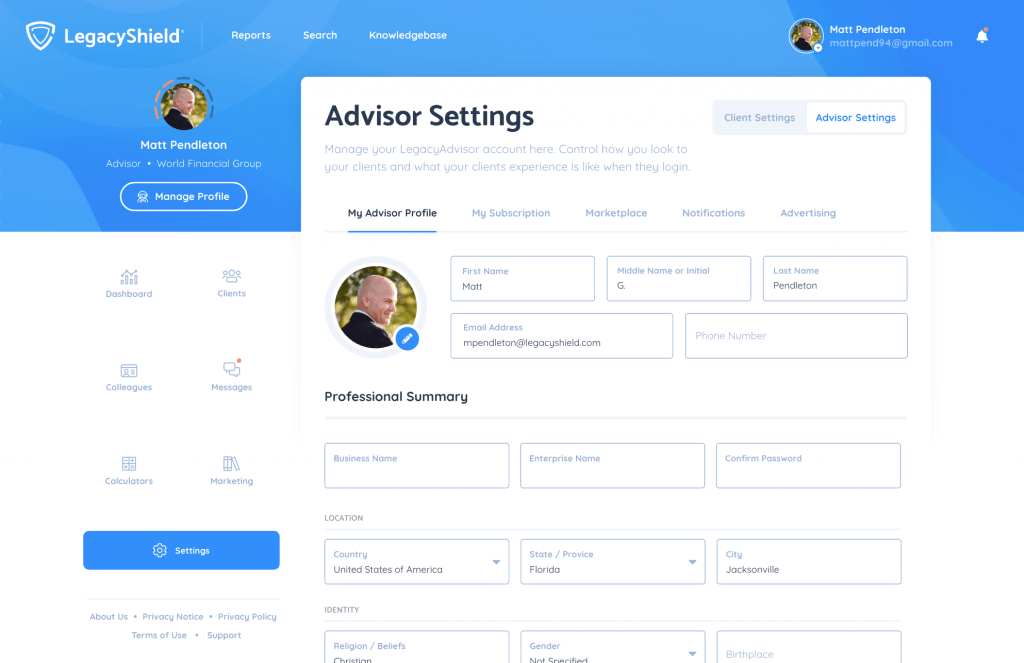

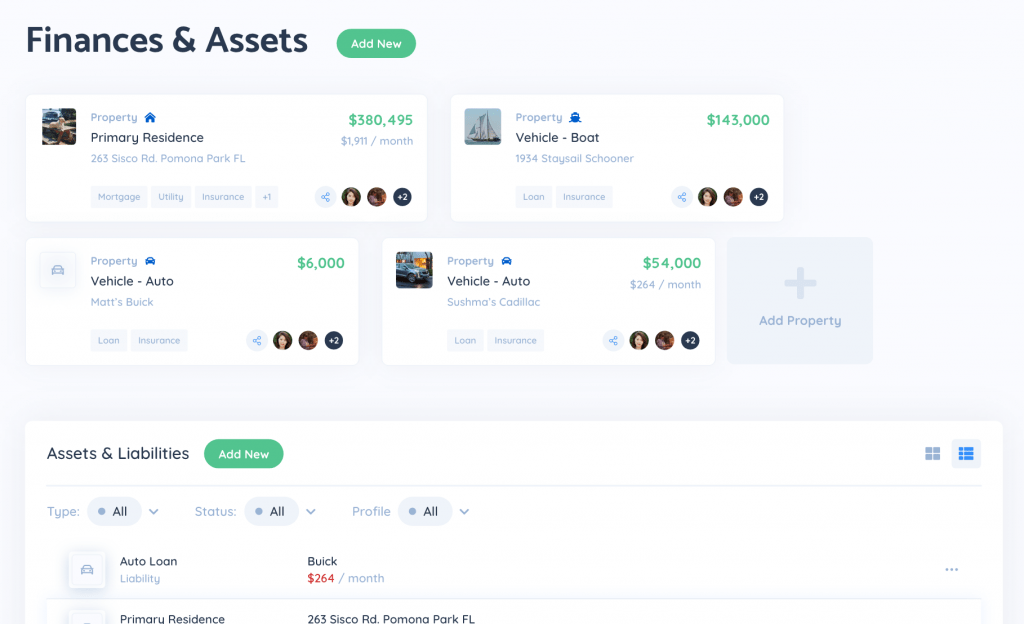

Link is our flagship product. It’s a platform that gives the advisor an infinite overview of their clients, their clients’ beneficiaries, and a snapshot of their clients’ finances – with one-of-a-kind tools to deliver your products and information to them digitally.

The all-in-one client networking platform of the future

What we can help you achieve

An organized book of business | Electronic product distribution | Secure online collaboration | Seamless information sharing | Dynamic connectivity | Advanced client insights

Meet The Family

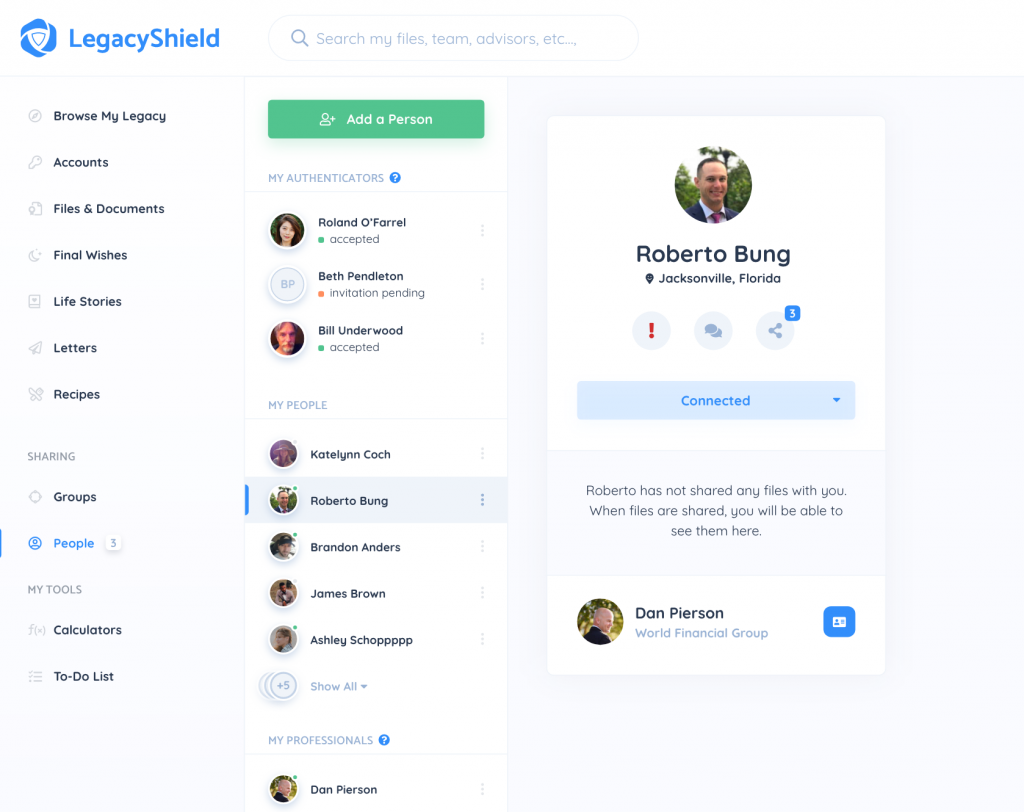

Network directly with the friends and family of your clients for new business and opportunities.

Get Acquainted

Gain insight and understanding into your client’s goals and needs like never before.

Share Digitally

File sharing in a secure online platform where you can talk and collaborate with clients.

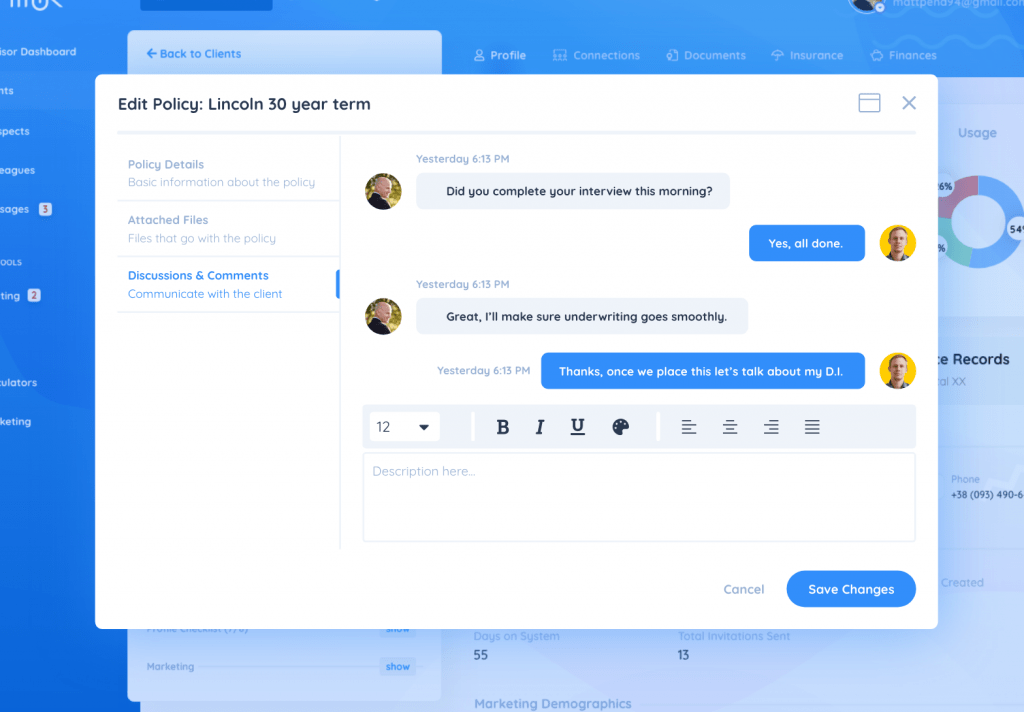

Have A Chat

Live online messaging is vital. You’ll never be out of touch with your clients again.

If you're ready to take your business to the next level, we have the solution.

See Your Book of

Business Differently

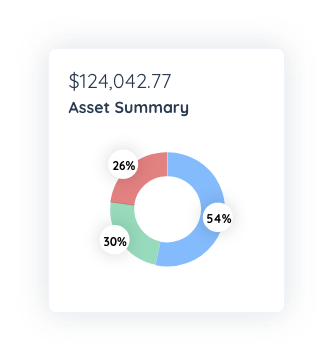

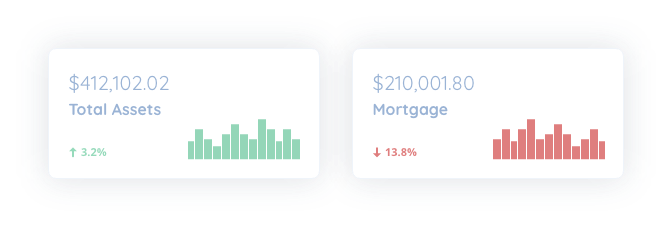

An omniscient overview of your clients and their financial well-being is the key to future business.

Collaborate With Your

Clients Online

Work together digitally to plan for the future and even deliver your products electronically!

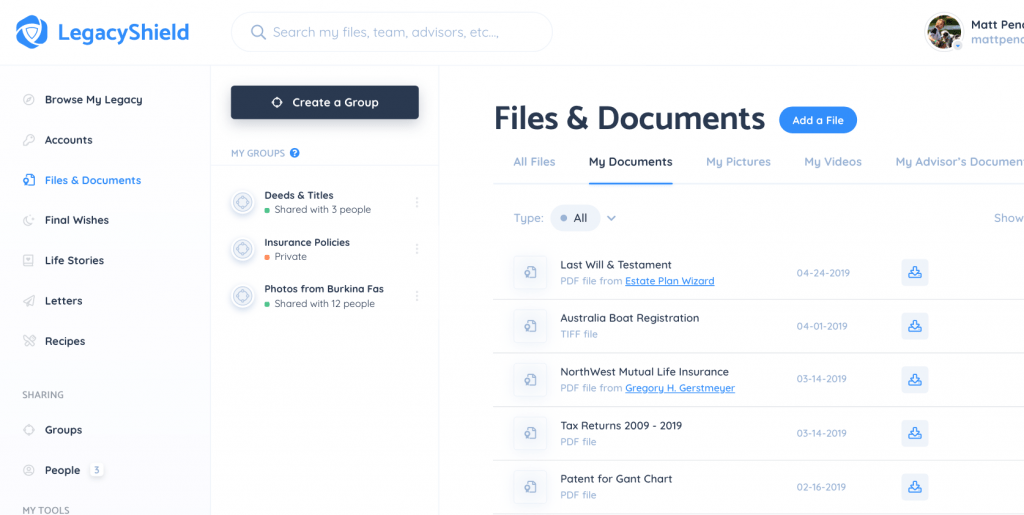

Give Your Clients A

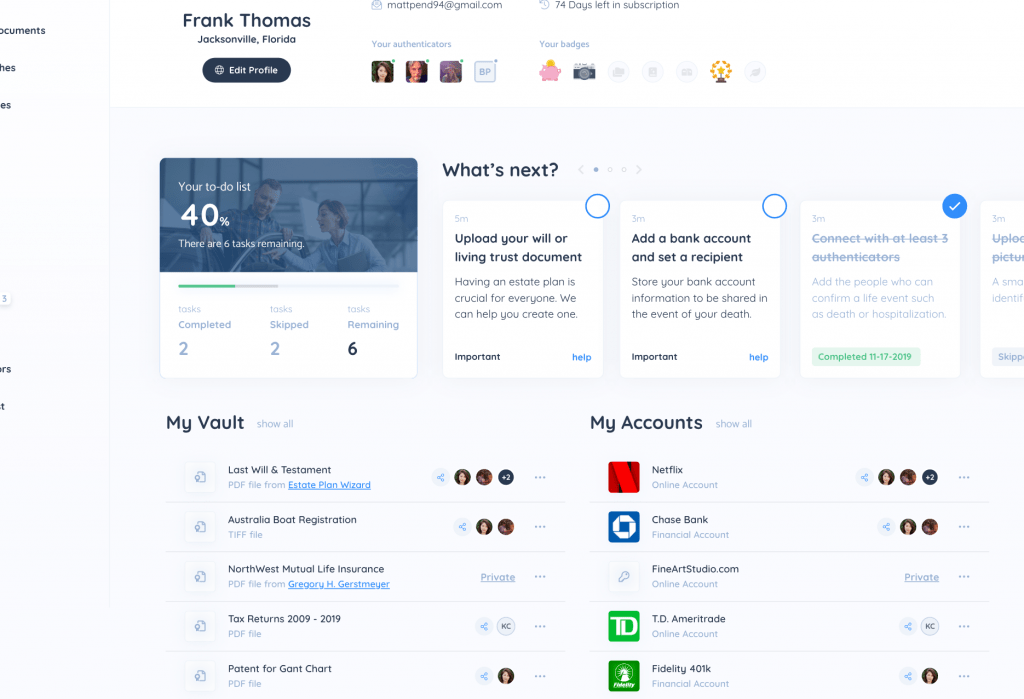

Place To Save Things

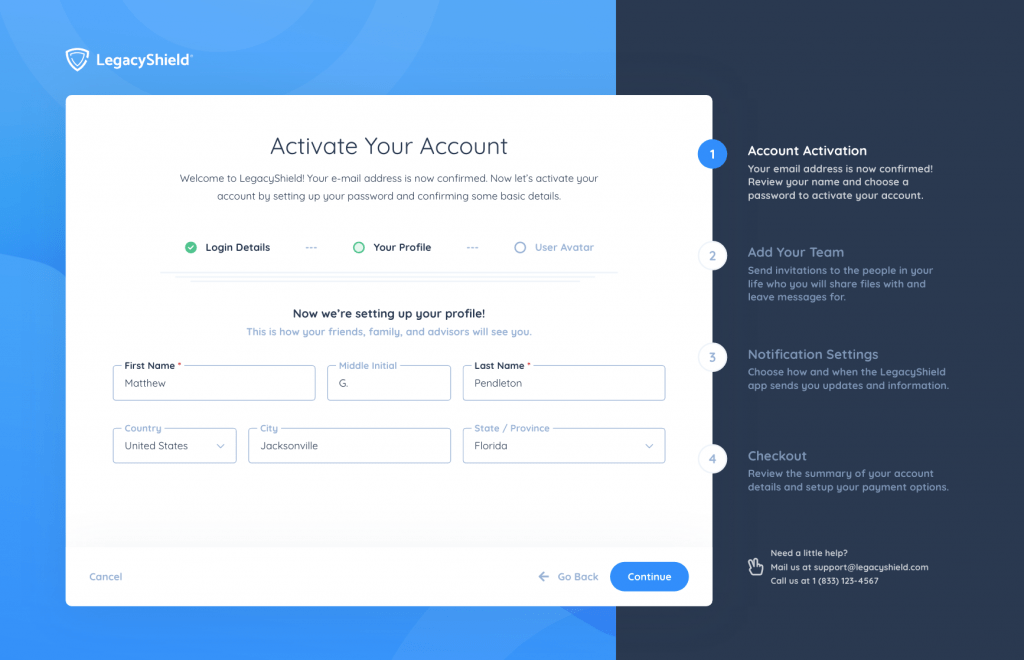

Your clients can use LegacyShield to store files, documents, insurance, and financial records.

Let Your Clients

Invite Their Families

Clients share their information and policies with friends and family. Those become your connections.

Unprecedented Collaboration

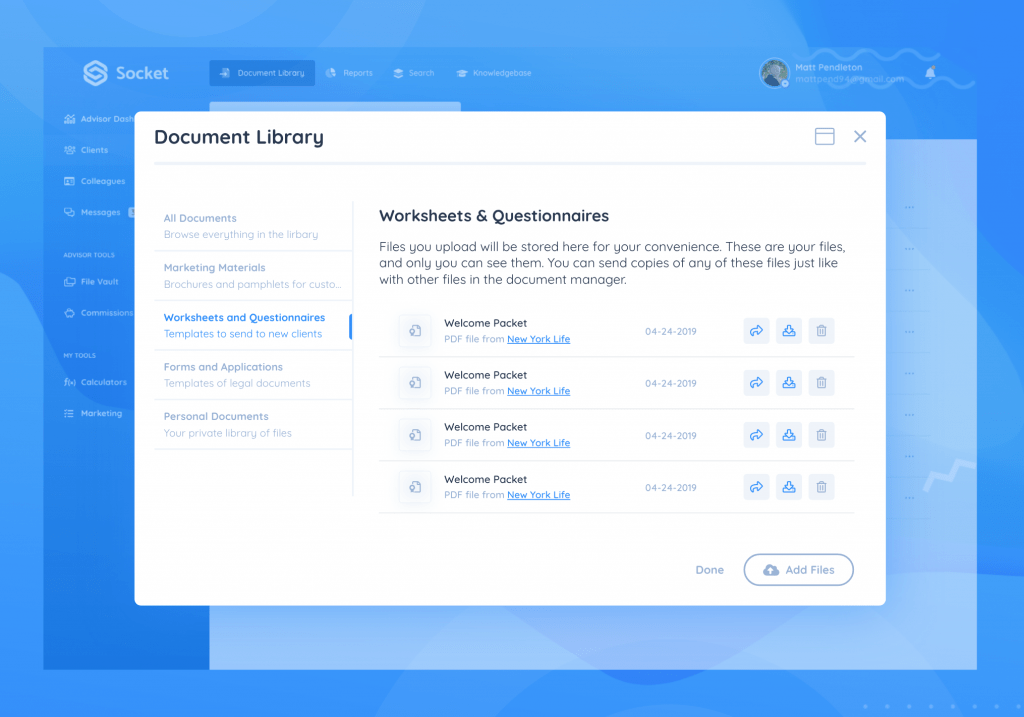

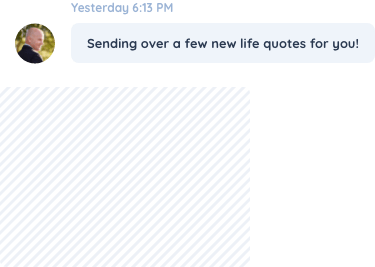

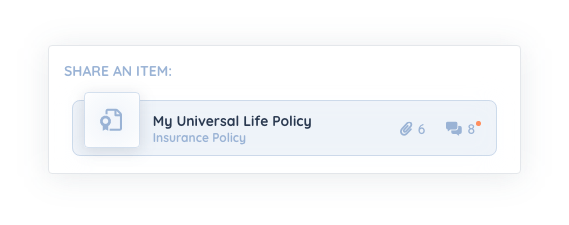

Share Files, Insurance Policies & Information Digitally

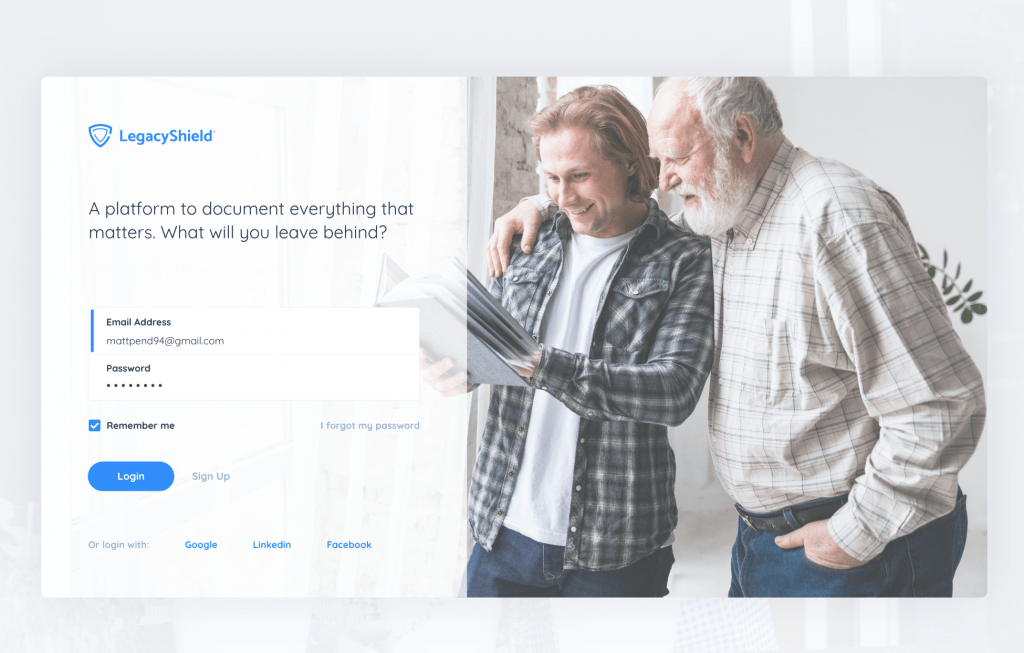

The world is digital. LegacyShield provides an easy and secure solution to deliver information and policies to your clients.

- Advisors use LegacyShield to work with clients in a digital environment. Deliver your products directly into their secure file storage system.

- Add notes and policy details to the files, where you and your clients can jointly access and collaborate on LegacyShield.

- Clients receive LegacyShield access to view information advisors share and while storing all their other important life information.

- LegacyShield gives you notifications when your clients view a file or make changes, providing greater insights so you can contact your clients at the right times.

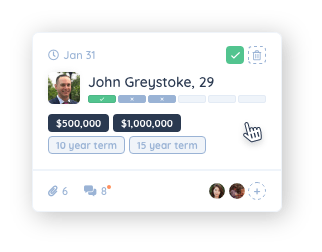

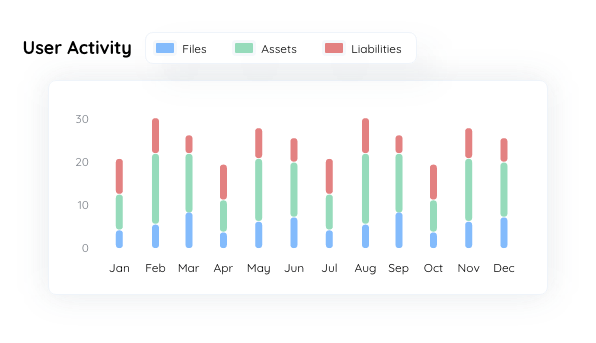

Next-level insights to understand your clients

Knowledge is power. With LegacyShield, advisors learn more about their clients. Know which clients are engaged and which need a little extra love. Identify gaps in coverage, recommend solutions, and build a connection with the clients’ entire network.

"I would urge advisors who are considering purchasing LegacyShield to consider this seriously. It's a small investment that I believe provides great returns and is a game-changer for any professional practice."

Kristina M. SmithInsurance Agent, CLTC

What happens if my subscription expires? Is my data safe?

Unless you specifically request your information to be deleted, we store your data securely and indefinitely. However, you would need to re-subscribe to gain access to your data.

Where do I go for help learning the features of LegacyShield?

You can learn more about LegacyShield by attending one of our monthly webinars or contacting our sales team at sales@18.220.128.78. We also have a client success team to provide advisors with a seamless experience. Utilizing the chat-bot feature can connect you to the client success team if you need immediate assistance. We are also in the process of creating knowledge-based articles to answer commonly asked questions.

Do my client's connections count toward my subscription?

No. Your subscription comes with unlimited second and third-degree connections. Only clients that you add count towards your subscription limit.

Can I connect with other professionals like underwriters in LegacyShield?

We are currently working on this feature for 2021.

Can I contact my client's connections?

Yes, but be tactful. LegacyShield provides a kit, including best practices and sample emails. Above all, remember that connections are likely important to your clients, and you will want to be respectful and mindful of how you approach connections.

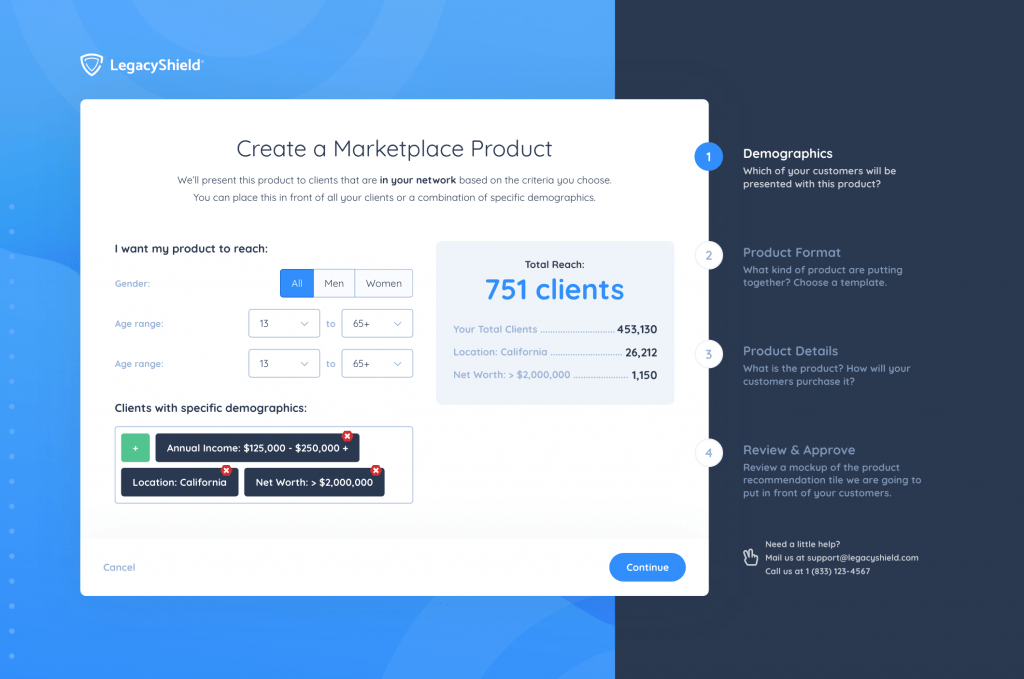

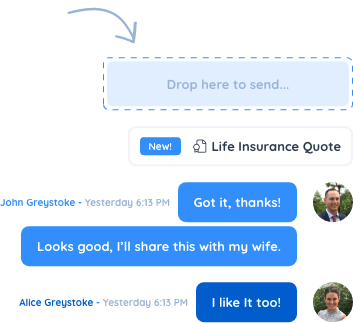

Seamless Sharing & Networking

Pass on Information and Provide Clients Peace of Mind

Do you have a solution for sharing your clients’ insurance policies and critical information with them and their loved ones? LegacyShield allows advisors to grow their book of business organically while providing clients with the quality and ease of use they desire.

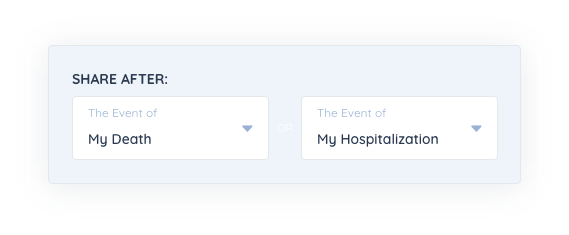

- Insurance policies, files, documents, account information, and more can all be shared at any time or automatically by preset life events or dates that you choose, such as death or hospitalization.

- When consumers connect with their friends and family, those connections become your new sales leads.

- Connected members can collaborate on information, which empowers you, the advisor, to connect across multiple generations.

Seamless Sharing & Networking

Build a Multi-Generational Book of Business

Clients who have a trust, will, or life insurance policy are often not forthcoming with information to their beneficiaries. In many cases, family members aren’t even aware that they are beneficiaries. Whether clients feel reluctant to discuss financial matters with family or discomfort when thinking about end-of-life planning, this lack of communication can lead to conflict, confusion, and even lost wealth.

- Build trust among your clients and their families. As you collaborate with the family, you act as a “financial quarterback” who creates and executes a successful, long-term plan. The more clients trust you, the more likely they will stay with you and buy additional products over time, and their family members may feel inclined to do the same.

- Differentiate you as an advisor. For many potential clients, an advisor who is eager to be a resource to both them and their families to close the loop fully is a major plus that will set you apart from other advisors.

- Keeps money in the clients’ family by putting measures in place, such as who can access what and at what time. For instance, it can prevent beneficiaries from treating the money as a windfall and immediately cashing out with the advisor to spend it.

Looking for a custom plan?

Schedule a demo to discuss more tailored subscription options that will match your business needs and budget.