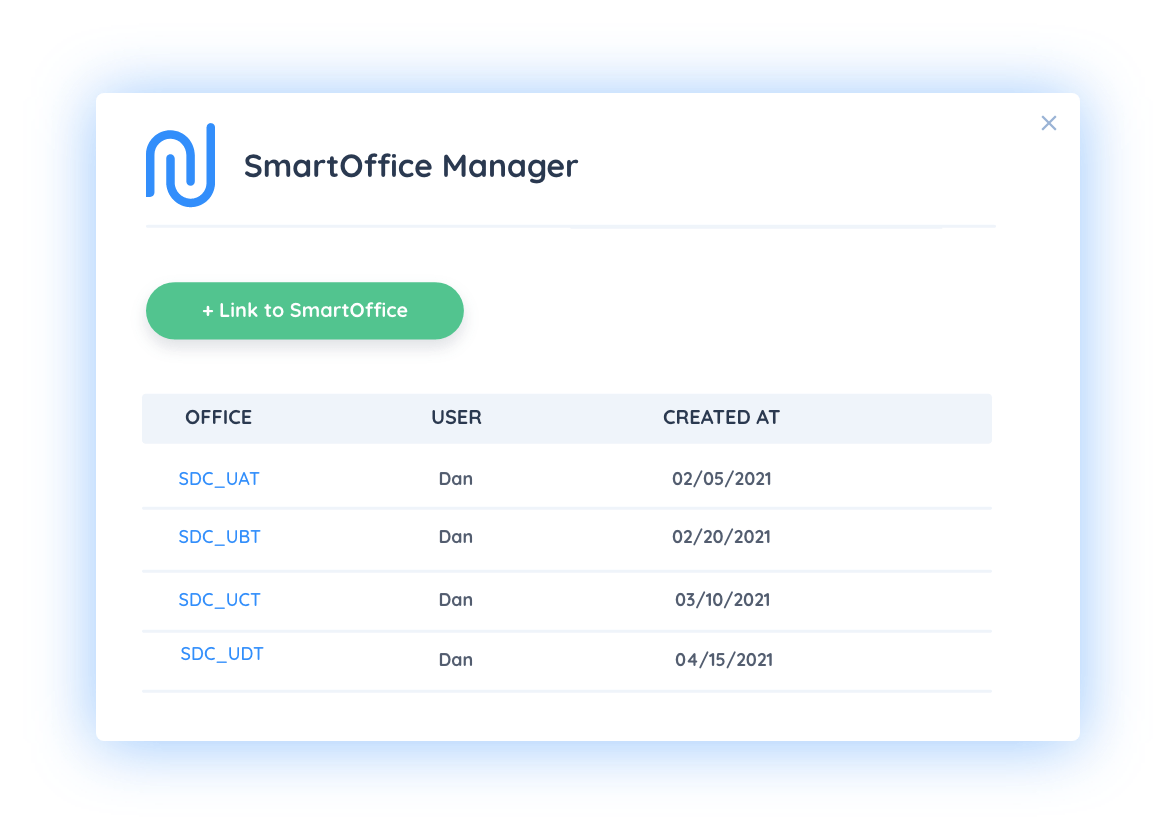

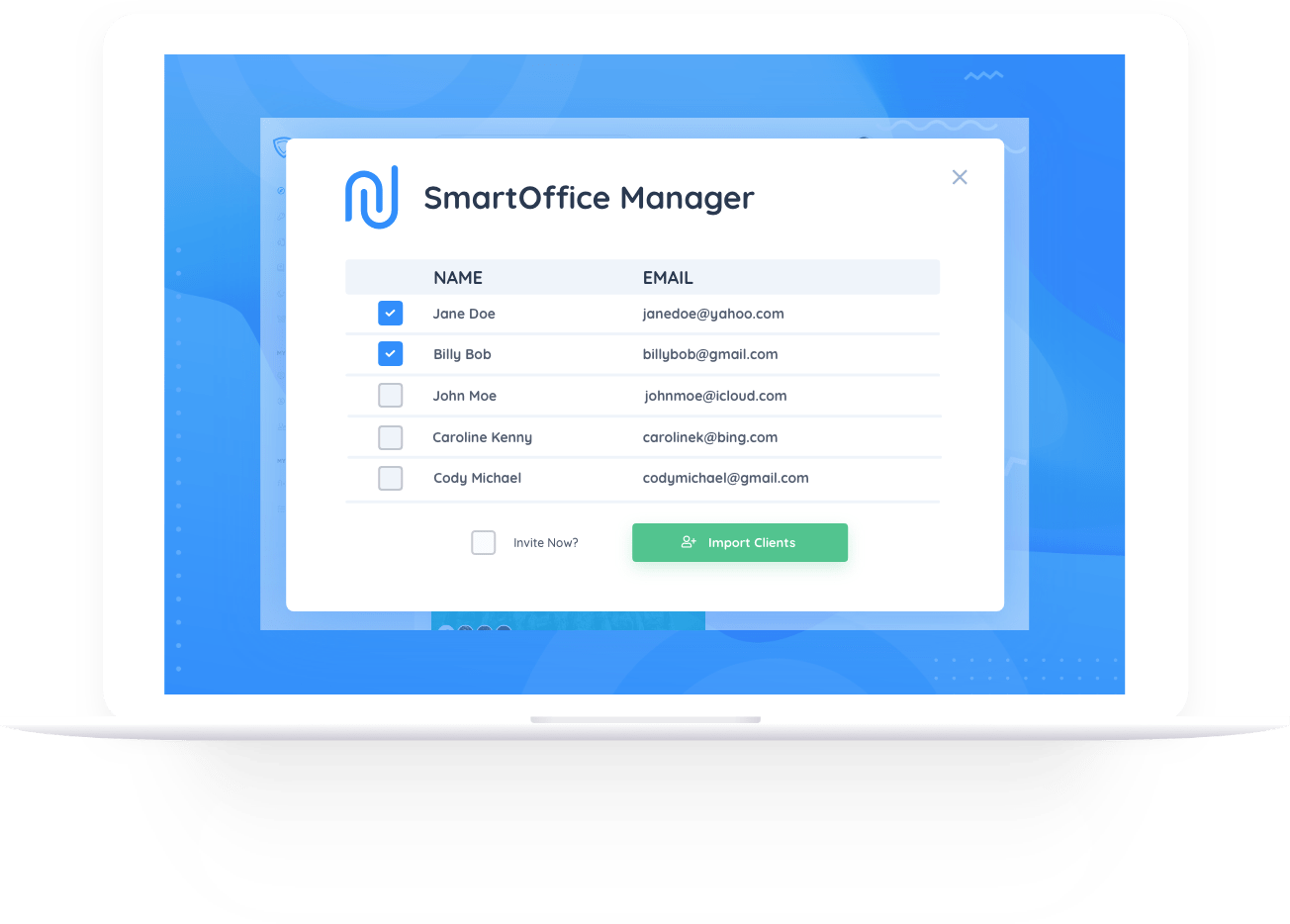

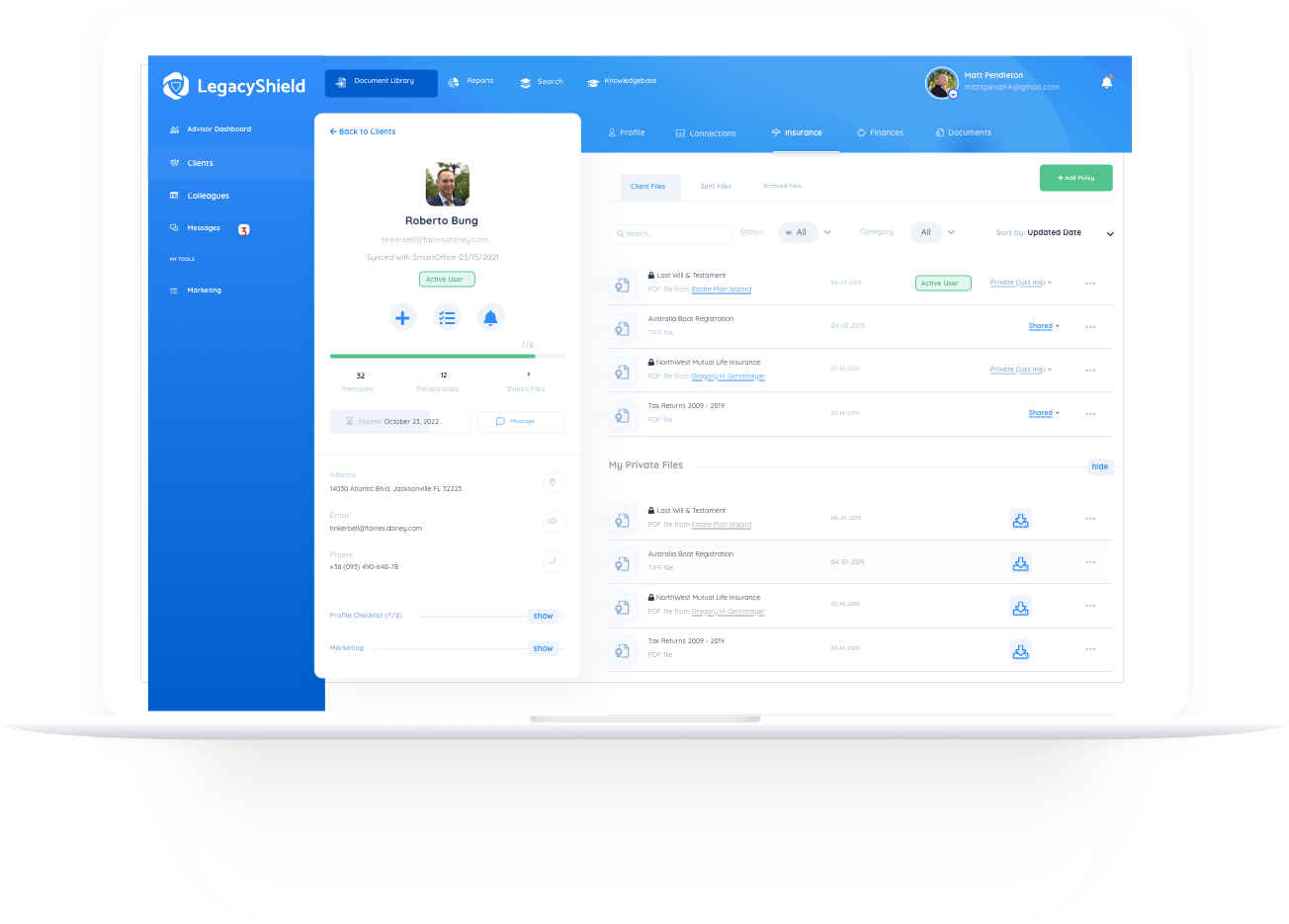

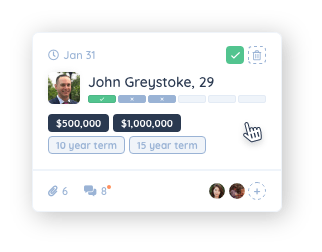

LegacyShield is a client networking platform that advisors use to communicate and share data with clients, beneficiaries, and other client connections in a completely compliant way. With this integration, users can quickly create client profiles in LegacyShield using data from SmartOffice.

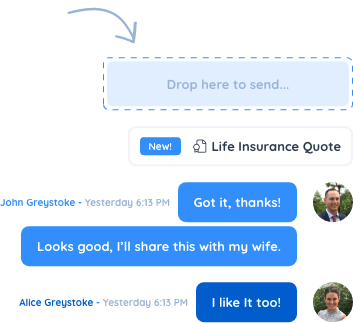

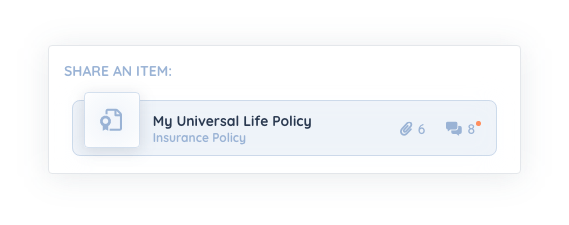

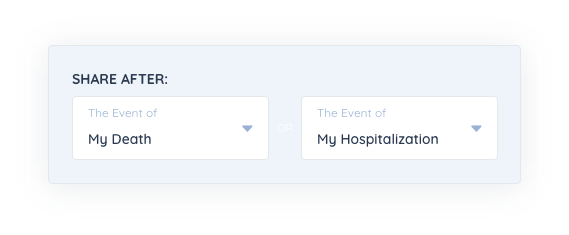

SmartOffice advisors can easily share data from their SmartOffice accounts with their clients. From pending policies to in-force business, advisors can keep their clients informed with the most relevant information. Plus, clients can seamlessly upload and share information with you, thanks to LegacyShield.